I was looking at some numbers this morning (despite it being a Sunday, my mind just won’t rest) and thought I’d share the general basis of determining value for hospitality properties. And this information is helpful to buyers and sellers.

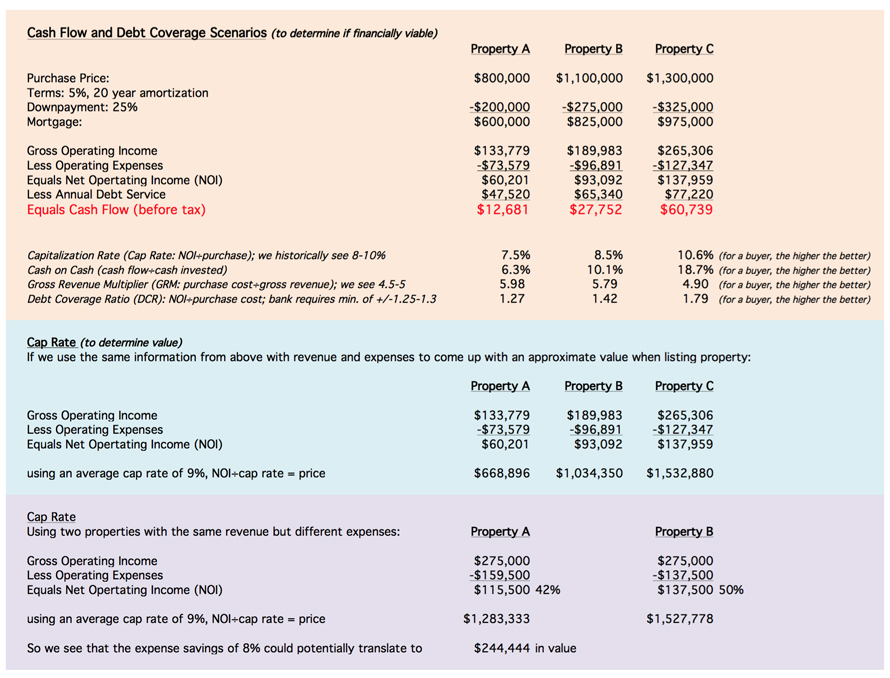

Here you first see a cash flow scenario based on three fictitious properties to see if each has a cash flow that would work if trying to obtain financing. Then I look at the three properties if using the same cap rate (cap rate is essentially a way of looking at a return on investment) and we’ve been seeing around a 9% as of late (not considering reserves and management fee, but that’s an appraisal topic for another blog post). The last scenario shows two properties with the same revenue but different expenses. And the bottom line is, if you control your expenses, you can increase your value. Of course if you can increase revenue and control expenses, that’s the best scenario!

As a buyer, you can see how putting a bit more down can potentially buy you a lot more cash flow.

It is natural to try and minimize your taxable gain (as any business owner) by expensing more on your tax return (rather than putting certain expenses on a depreciation schedule), but in the end, the value of your inn when you go to sell is based primarily on your last three years of tax returns! Visit my website (“Understanding Value”) for a link to a full spreadsheet in a pdf format.

For buyers, there really isn’t enough information here about Property A, B or C to make a decision on what you’d want to buy. Factors such as location, lifestyle you choose (and at what pace/occupancy), staff or no staff, etc. could affect your decision. Some buyers want to own a B&B that can provide a comfortable pace, and not opt for a high performing one.

A lot goes into choosing the right property for you.