As a home buyer, you understand what it means to qualify for a home loan, your salary has to cover your current debt and a new house mortgage. The bank wants you to be within a certain debt to income ratio. Pretty simple.

With buying a lodging/hospitality property, if you are leaving your job, how do you qualify for a purchase? It’s based on the property’s financial performance.

If you are able to work remotely and keep your job and purchase an inn, then you might qualify based on both your salary and the property’s financial performance.

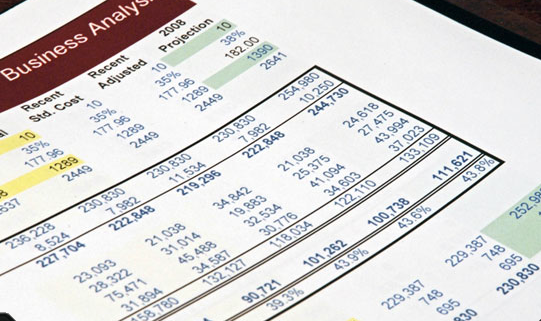

So how do you know what price point to consider? It is based on what your available cash will be for a downpayment at closing. So then we have to run cash flow scenarios in order to see if the property’s financials work with 20% down, or 25% down or do you need to put more down in order to adequately cover the debt? This is where working with an experienced hospitality broker helps. I can find inns that should fit within your available downpayment. That source can be from house sale proceeds, investments, 401k rollover, 1031 exchange, etc.

Contact me to discuss!