When we hear the question “have you pre-qualified your clients?” in a residential transaction it usually means that your buyer has been in touch with a lender, submitted their personal financial statement and received a “pre-qual” letter from the bank. This letter would state that based on the buyer’s financials and their job income, they are capable of purchasing something in the $xxx range.

But in a commercial transaction it doesn’t happen like this. Since commercial deals are almost always based on the financial performance of the business and analysis of the net operating income, until a buyer can submit the financial statements for the business they’re interested in pursuing, the lender can’t give them any type of pre-qualification.

What we, as buyer brokers, do is we vet our buyers to determine what their available cash will be for a downpayment, what their cash reserves might be so that we know realistically what property might or might not work for them. Not what price range necessarily (as in a residential transaction) but what their available cash for downpayment might afford them.

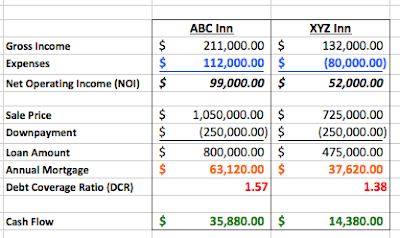

While a $250,000 downpayment might afford a $750,000 if the property’s NOI is high enough, it might better afford a $1,000,000 property if the NOI is strong enough. Here’s an example: